Why Bundling Insurance Policies Can Save You More Money

Why Bundling Insurance Policies Can Save You More Money

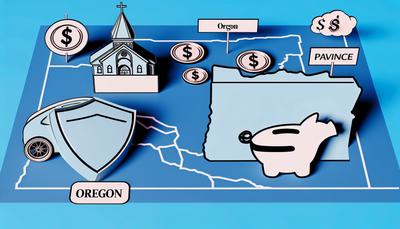

When it comes to saving money on insurance, many people overlook one of the simplest strategies: bundling their policies. Whether you're insuring your car, home, or other valuable assets, combining multiple policies under a single provider can lead to substantial savings and added conveniences.

What Is Insurance Bundling?

Insurance bundling refers to purchasing multiple types of insurance—such as auto, home, and renters insurance—from the same provider. Many insurance companies offer discounts when you bundle policies, making it a popular choice for cost-conscious consumers.

The Key Benefits of Bundling Insurance

1. Significant Cost Savings

One of the biggest advantages of bundling insurance is the potential for lower premiums. Many insurers provide multi-policy discounts that can reduce overall insurance costs by 10% to 25%. This can be especially beneficial for Oregon residents looking for auto insurance savings.

2. Simplified Policy Management

Keeping track of multiple policies from different insurers can be a hassle. Bundling allows you to manage all your coverage under a single provider, simplifying billing and communication.

3. Enhanced Coverage Options

Some insurance companies offer extra perks or better coverage terms when you bundle policies. These may include higher liability limits, accident forgiveness, or added protections that wouldn't be available with standalone policies.

4. Stronger Customer Loyalty Incentives

Bundled customers are often given priority service, lower deductibles, or renewal discounts. Insurers value long-term relationships, and bundling can make you eligible for exclusive deals over time.

How to Maximize Your Insurance Bundle Savings

1. Compare Bundling Discounts Across Providers

Not all insurance companies offer the same bundling discounts. It's essential to shop around and compare quotes to ensure you're getting the best deal.

2. Assess Your Coverage Needs Carefully

While bundling can save money, it's crucial to ensure you're not paying for unnecessary coverage. Work with your agent to adjust your policy details to match your specific needs.

3. Ask About Additional Perks

Some insurers offer additional incentives beyond discounts, such as accident forgiveness, roadside assistance, or identity theft protection. Inquire about these extras when bundling your policies.

Is Bundling Right for You?

Bundling insurance can be a fantastic way to save money while simplifying your financial planning. However, it's important to evaluate your specific needs and compare offers from different providers. If you're an Oregon resident looking for auto insurance savings, bundling your policies could be one of the best ways to cut costs while maintaining comprehensive coverage.

Final Thoughts

If you're paying for separate auto and home insurance policies, it's time to explore bundling options. By taking advantage of multi-policy discounts, you can enjoy lower premiums, streamlined management, and added perks. Start by speaking with your insurance provider today and see how much you can save!